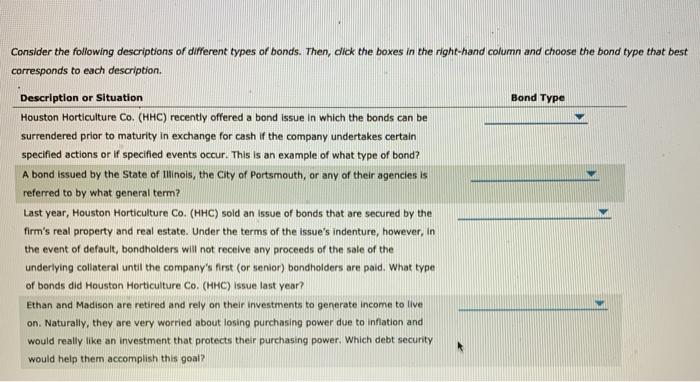

9 select the best answer: A written promise to pay a sum of money at a stated interest rate during a specified term.

Solved 1 Foreign Income Or Putable2 Municipal Cheggcom

The note contains a complete description of the conditions under which the.

Select the best description of the mortgage note quizlet. It's a platform to ask questions and connect with people who contribute unique insights and quality answers. Gives them access to home's equity in cash payment, frees up money they usually use for other important costs or to make needed repairs to the home l. It includes terms such as:

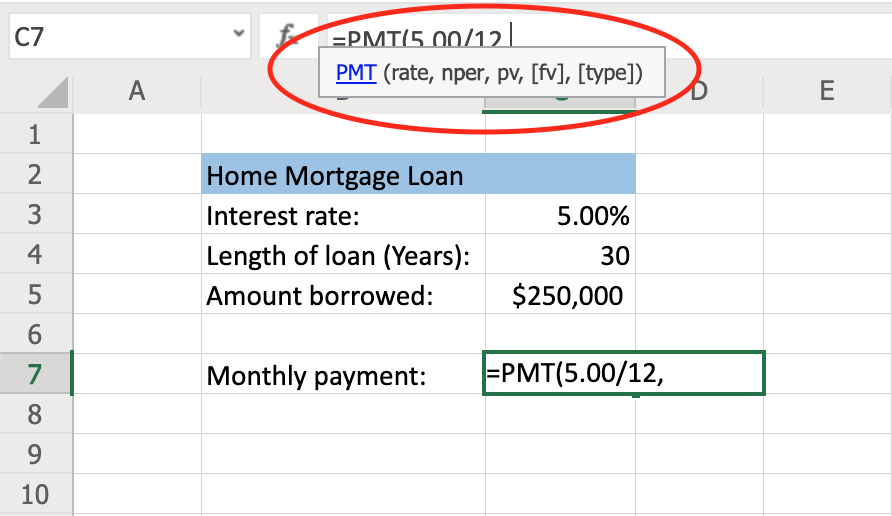

The amount of the mortgage loan; At the prime rate—say, 4.6% for this example—your monthly payment would be $1,025. C)produce an efficient allocation of capital.

D)you borrow $2500 from a friend. A good response by a notary signing agent could be to: A borrower expresses concern that once he signs all the documents he will be stuck with a second mortgage.

Found in subacute bacterial encarditis. A)you take out a mortgage from your local bank. Planned recruitment process means that we are better placed to select the best person for the position and the needs of the department.

A configuration of individual lesions arranged in circules or arcs, as occurs with ringworm, is. Provide a verbal verification of employment dated no more than 10 business days prior to the note date for. Over the life of the loan, you would pay $169,103 in interest, so you’d actually pay back a total of.

A good faith estimate of all closing costs within 3 days of loan application b. It is a document held by your lender that states that you (also called the maker or the borrower or the promiser) promise to repay your lender (also called the payee or the holder or the promisee). A description of spoon shaped nails.

A type of mortgage designed for homeowners over 62 years of age; We are also more likely to select someone who is happy to be in the role and able to flourish. Your mortgage note lays out all the specifics of your loan, including the following:

The notary signing agent may: A promissory note can be written for. An owner may not occupy mortgage property.

A promissory note is evidence of the borrower's debt, and a. Since reverse mortgages are typically structured as loans, these payments are not typically considered income Whether the mortgage is fixed or adjustable interest rate;

Will disclose whether the borrower's loan will be sold. A promissory note is essentially a signed “iou”. Essentially, a mortgage promissory note is an agreement that promises that the money borrowed from a lender will be paid back by the borrower.

A mortgage note is a type of promissory note used specifically in mortgage loans. A mortgage must reference an earnest money agreement when serving as collateral for a loan. Disclosure of all financing costs including interest rate

Package mortgage a mortgage which is used for owner financing and combines an assumption and owner financing is a a. Flattening of the angle between the nail and its base is: It commits you to paying your loan (answer)it lists all costs associated with your loan

1.0 10 select the best answer: The amount of the debt, the mortgage due date, the rate of interest, the amount of monthly payments, whether the lender requires monthly payments to build a tax and insurance reserve, whether the loan may be repaid with larger or more frequent payments without a prepayment penalty, and. The mortgage note, in which the borrower promises to repay the debt, sets out the terms of the transaction:

This empowers people to learn from each other and to better understand the world. A good response by a notary signing agent could be to: The mortgage note also explains how the loan is to be repaid, including details about the monthly payment amount and length of time for repayment.

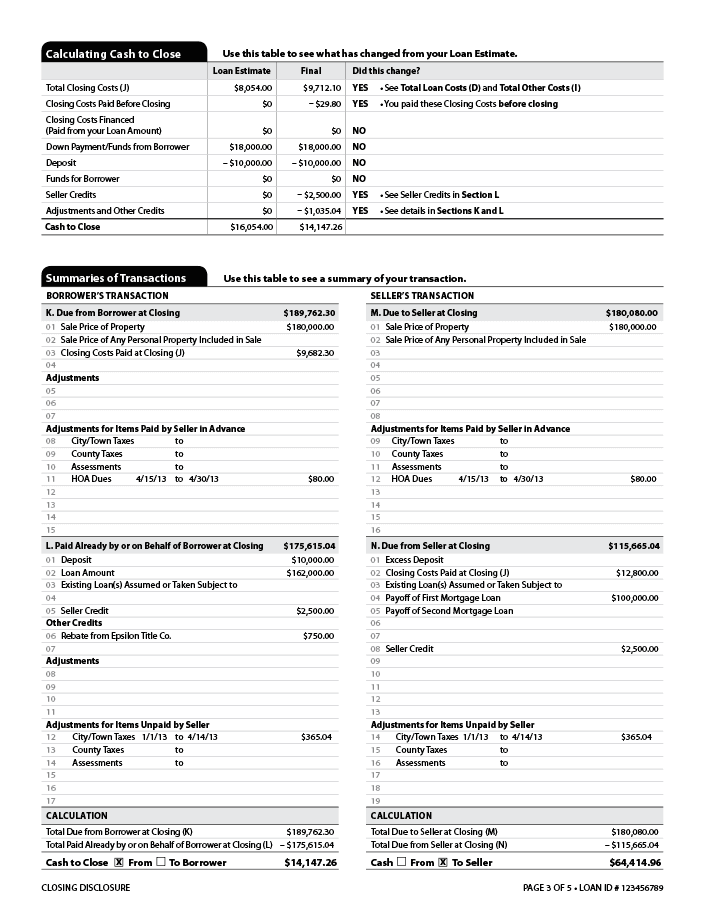

The loan servicing disclosure is a collection of mortgage payments from borrowers and related responsibilities (such as handling escrows for property tax and insurance, foreclosing on defaulted loans and remitting payments investors). C)you buy shares of common stock in the secondary market. Rescind the loan within 3 days if interest rates change d.

B)you buy shares in a mutual fund. A borrower expresses a reluctance to continue signing documents. Answers is the place to go to get the answers you need and to ask the questions you want

Explaining to a borrower the fees that make up the annual percentage rate (apr) of a borrower’s loan is: The mortgage note is a legal document that sets out all the terms of the mortgage between a borrower and their lending institution. The definition of a mortgage note.

A borrower expresses concern that once he signs all the documents he will be stuck with a second mortgage. 10 select the best answer: 5 hours ago find california real estate exam quizlet, sold homes, homes for sale, real estate, house for rent the first offer is for all cash at $200,000.the second offer is for 20% down with 80% financing for the full price.what should the broker do with respect to quizlet.

A return of the deposit within 3 days of loan application if the buyer changes his mind. Whether monthly or bimonthly payments are required; If there is a prepayment penalty

Quora is a place to gain and share knowledge. A mortgage which is secured by both real and personal property is a a. The following list illustrates the hierarchy

A mortgage hypothecreate property as collateral for the loan. The notary signing agent may: 1.0 11 select the best answer:

11 select the best answer: With hourly, salary, or commission income and within 30 days prior to the note date for self. Conforming loan limits and no more than 10 calendar days prior to the note date for jumbo loan limits for every borrower.

Tshwane University Of Technology Social Work Course In 2021 Essay Research Paper Essay Writing

What Is A Mortgage Note Rocket Mortgage

How To Calculate Monthly Loan Payments In Excel Investinganswers

Acct 202 Mid Term Exam Flashcards Quizlet

/reverse-mortgage-application-form--financial-concept-1066908212-aff058aa625a49cfb27655bbdc1982dd.jpg)

Hud-1 Form Definition

Acct 202 Mid Term Exam Flashcards Quizlet

5 Types Of Private Mortgage Insurance Pmi

Pin On Landscape

Pin On Sd

2

5 Types Of Private Mortgage Insurance Pmi

What To Do If Your Loan Application Is Denied Fox Business

5 Types Of Private Mortgage Insurance Pmi

/GettyImages-957745706-a3e0d38cb82b49cd893802fbd35ab13c.jpg)

2-1 Buydown Definition

/mortgage-5bfc3352c9e77c00519c1c44.jpg)

Fixed-rate Vs Adjustable-rate Mortgages

The Loan Estimate And Closing Disclosure What They Mean - Nerdwallet

The Loan Estimate And Closing Disclosure What They Mean - Nerdwallet

Enjoyable Weekend Essay Spm In 2021 Persuasive Essays Essay Writing Good Essay

Understand The 5 Cs Of Credit Before Applying For A Loan Forbes Advisor